Multiple Choice

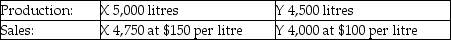

Use the information below to answer the following question(s) .Chem Manufacturing Company processes direct materials up to the splitoff point, where two products (X and Y) are obtained and sold.The following information was collected for the month of November.Direct materials processed:

10,000 litres (10,000 litres yield 9,500 litres of good product and 500 litres of shrinkage)

The cost of purchasing 10,000 litres of direct materials and processing it up to the splitoff point to yield a total of 9,500 litres of good products was $975,000.The beginning inventories totalled 50 litres for X and 25 litres for Y.Ending inventory amounts reflected 300 litres of product X and 525 litres of product Y.October costs were per unit were the same as November.

The cost of purchasing 10,000 litres of direct materials and processing it up to the splitoff point to yield a total of 9,500 litres of good products was $975,000.The beginning inventories totalled 50 litres for X and 25 litres for Y.Ending inventory amounts reflected 300 litres of product X and 525 litres of product Y.October costs were per unit were the same as November.

-The Arvid Corporation manufactures widgets, gizmos, and turnbols from a joint process.May production is 4,000 widgets; 7,000 gizmos; and 8,000 turnbols.Respective per unit selling prices at splitoff are $15, $10, and $5.Joint costs up to the splitoff point are $75,000.If joint costs are allocated based upon the sales value at splitoff, what amount of joint costs will be allocated to the widgets?

A) $30,882

B) $26,471

C) $17,647

D) $28,125

E) $60,000

Correct Answer:

Verified

Correct Answer:

Verified

Q100: Framingham Ltd.produces three products out of a

Q101: Recognition of byproducts in the financial statements

Q102: Match each of the following costs with

Q103: Byproduct revenues appear in the income statement

Q104: Cando Company processes 40,000 litres of direct

Q107: Use the information below to answer the

Q108: Match each of the following costs with

Q109: BC Lumber Company prepares lumber for companies

Q110: The amount of the joint costs is

Q115: Joint costs are incurred beyond the split-off