Multiple Choice

Answer the following question(s) using the information below.

Beta Shoe Ltd. manufactures only one type of shoe and has two divisions, the Sole Division, and the Assembly Division. The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers. The Sole Division "sells" soles to the Assembly Division. The market price for the Assembly Division to purchase a pair of soles is $20. (Ignore changes in inventory.) The fixed costs for the Sole Division are assumed to be the same over the range of 40,000-100,000 units. The fixed costs for the Assembly Division are assumed to be $7 per pair at 100,000 units.

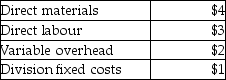

Sole's costs per pair of soles are:

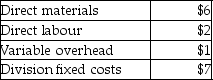

Assembly's costs per completed pair of shoes are:

Assembly's costs per completed pair of shoes are:

-If the Assembly Division sells 100,000 pairs of shoes at a price of $60 a pair to customers, what is the operating income of both divisions together?

A) $4,400,000

B) $3,400,000

C) $3,000,000

D) $2,600,000

E) $2,400,000

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Department A charges Department B $1,350 for

Q12: The essence of decentralization is the freedom

Q29: Crush Company makes internal transfers at 180%

Q33: The Micro Division of Silicon Computers produces

Q34: Use the information below to answer the

Q41: Management control systems reflect only financial data.

Q93: Explain what transfer prices are, and what

Q102: A Canadian company has subsidiaries in France,

Q144: There is seldom a single transfer price

Q183: The price one subunit of an organization