Multiple Choice

Answer the following question(s) using the information below.

Cool Air Ltd. manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $77. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $15.00 per unit at 10,000 units.

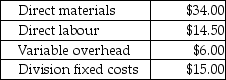

Compressor's costs per compressor are:

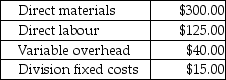

Assembly's costs per completed air conditioner are:

Assembly's costs per completed air conditioner are:

-If the Assembly Division sells 1,000 air conditioners at a price of $750.00 per air conditioner to customers, what is the operating income of both divisions together?

A) $200,500

B) $207,000

C) $194,000

D) $165,750

E) $230,500

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A company has a plant in a

Q9: Payne Ltd. has two divisions. The Compound

Q15: Full-cost transfer prices will maximize overall corporate

Q16: The Transportation Division of Petrolia Paint Company

Q27: Discuss the possible problems a corporation might

Q48: All of the following are benefits of

Q96: Use the information below to answer the

Q136: Answer the following question(s)using the information below.Beta

Q165: Market price is the only price that

Q173: Use the information below to answer the