Multiple Choice

Answer the following question(s) using the information below:

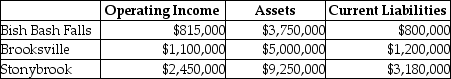

Coldbrook Company has two sources of funds: long-term debt with a market and book value of $15 million issued at an interest rate of 10%, and equity capital that has a market value of $9 million (book value of $5 million) .Coldbrook Company has profit centres in the following locations with the following operating incomes, total assets, and current liabilities.The cost of equity capital is 15%, while the tax rate is 30%.

-Novella Ltd.reported a return on investment of 16%, an asset turnover of 6, and income of $190,000.On the basis of this information, the company's invested capital was

A) $1,187,500.

B) $7,125,000.

C) $1,140,000.

D) $197,917.

E) $182,400.

Correct Answer:

Verified

Correct Answer:

Verified

Q143: List and describe the steps involved in

Q144: Use the information below to answer the

Q145: The imputed cost of an investment is

Q146: In establishing performance measures and compensation policy,

Q147: A company has total assets of $500,000,

Q149: What disadvantage is there in using ROI

Q150: Kase Tractor Company allows its divisions to

Q151: Use the information below to answer the

Q152: The absence of good performance measures restricts

Q153: Answer the following question(s)using the information below:<br>Carriage