Multiple Choice

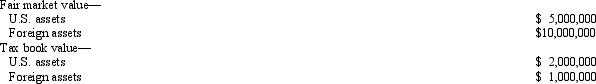

Flan, a U.S. corporation, reports $250,000 interest expense for the tax year. None of the interest relates to nonrecourse debt or loans from affiliated corporations. Flan's U.S. and foreign assets are as follows.  How should Flan assign its interest expense between U.S. and foreign sources to maximize its FTC for the current year?

How should Flan assign its interest expense between U.S. and foreign sources to maximize its FTC for the current year?

A) Using tax book values.

B) Using tax book value for U.S. source and fair market value for foreign source.

C) Using fair market value.

D) Using fair market value for U.S. source and tax book value for foreign source.

Correct Answer:

Verified

Correct Answer:

Verified

Q28: Which of the following foreign taxes paid

Q28: Which of the following is not a

Q30: Which of the following items of CFC

Q33: All of an NRA's U.S.-source income that

Q36: Which of the following would not prevent

Q38: Copp, Inc., a domestic corporation, owns 30%

Q51: An appropriate transfer price is one that

Q91: The purpose of the transfer pricing rules

Q93: A controlled foreign corporation (CFC) realizes Subpart

Q107: ForCo, a foreign corporation, receives interest income