Multiple Choice

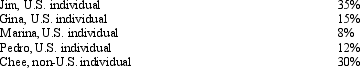

The following persons own Schlecht Corporation, a foreign corporation.  None of the shareholders are related. Subpart F income for the tax year is $300,000. No distributions are made. Which of the following statements is correct?

None of the shareholders are related. Subpart F income for the tax year is $300,000. No distributions are made. Which of the following statements is correct?

A) Schlecht is not a CFC.

B) Chee includes $90,000 in gross income.

C) Marina is not a U.S. shareholder.

D) Marina includes $24,000 in gross income.

E) None of the above statements is correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Dividends received from Leprechaun, Ltd., an Irish

Q39: Chang, an NRA, is employed by Fisher,

Q46: U.S.individuals who receive dividends from foreign corporations

Q69: Peanut, Inc., a domestic corporation, receives $500,000

Q75: Match the definition with the correct term.<br>

Q76: Which of the following statements regarding a

Q85: Jokerz, a CFC of a U.S.parent, generated

Q101: Kilps,a U.S.corporation,receives a $200,000 dividend from a

Q114: A U.S. taxpayer may take a current

Q135: Which of the following statements regarding the