Multiple Choice

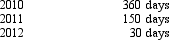

Shannon, a foreign person with a green card, spends the following days in the United States.  Shannon's residency status for 2012 is:

Shannon's residency status for 2012 is:

A) U.S. resident because she has a green card.

B) U.S. resident since she was a U.S. resident for the past immediately preceding two years.

C) Not a U.S. resident because Shannon was not in the United states for at least 31 days during 2012.

D) Not a U.S. resident since, using the three-year test, Shannon is not present in the United states for at least 183 days.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Which of the following statements regarding the

Q21: A domestic corporation is one whose assets

Q76: Flapp Corporation, a domestic corporation, conducts all

Q84: Gain or loss on the exchange of

Q88: Which of the following statements regarding income

Q91: If a foreign corporation's U.S. effectively connected

Q92: Young,Inc. ,a U.S.corporation,earns foreign-source income classified in

Q108: U.S.income tax treaties:<br>A)Provide rules by which multinational

Q127: Waltz,Inc.,a U.S.taxpayer,pays foreign taxes of $50,000 on

Q143: GreenCo, a domestic corporation, earns $25 million