Multiple Choice

Yvonne is a citizen of France and does not have permanent resident status in the United States. During the last three years she has spent a number of days in the United States.  Is Yvonne treated as a U.S. resident for the current year?

Is Yvonne treated as a U.S. resident for the current year?

A) No, because Yvonne is a citizen of France.

B) No, because Yvonne was not present in the United States at least 183 days during the current year.

C) No, because although Yvonne was present in the United States at least 31 days during the current year, she was not present at least 183 days in a single year during the current or prior two years.

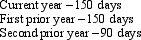

D) Yes, because Yvonne was present in the United States at least 31 days during the current year and 215 days during the current and prior two years (using the appropriate fractions for the prior years) .

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Jilt,a non-U.S.corporation,not resident in a treaty country,operates

Q26: GlobalCo, a foreign corporation not engaged in

Q39: Discuss the primary purposes of income tax

Q54: The IRS can use § 482 reallocations

Q73: The transfer of the assets of a

Q127: Which of the following statements regarding the

Q146: A nonresident alien with U.S.-source income effectively

Q147: USCo, a domestic corporation, receives $100,000 of

Q148: Amber, Inc., a domestic corporation receives a

Q153: "Inbound" and "offshore" transfers are exempt from