Essay

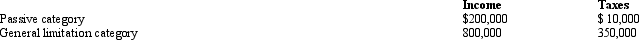

Britta, Inc., a U.S. corporation, reports foreign-source income and pays foreign taxes as follows.

Britta's worldwide taxable income is $1,600,000 and U.S. taxes before FTC are $560,000 (assume a 35% tax rate). What is Britta's U.S. tax liability after the FTC?

Britta's worldwide taxable income is $1,600,000 and U.S. taxes before FTC are $560,000 (assume a 35% tax rate). What is Britta's U.S. tax liability after the FTC?

Correct Answer:

Verified

The FTC is computed separately for both ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q35: Hendricks Corporation, a domestic corporation, owns 40

Q39: Julio, a nonresident alien, realizes a gain

Q43: Generally, accrued foreign taxes are:<br>A) Translated at

Q44: Present, Inc., a domestic corporation, owns 60%

Q49: Match the definition with the correct term.<br>

Q51: Which of the following persons typically is

Q72: ForCo, a subsidiary of a U.S. corporation

Q98: The U.S.system for taxing income earned outside

Q122: Losses and deductions, similar to income items,

Q140: RedCo, a domestic corporation, incorporates its foreign