Multiple Choice

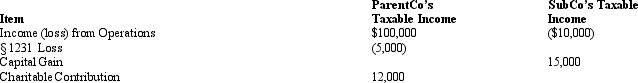

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

ParentCo SubCo

A) $85,000 $5,000

B) $85,000 $3,000

C) $85,500 $5,000

D) $85,500 $3,000

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Which of the following is eligible to

Q63: The starting point in computing consolidated taxable

Q69: Most of the Federal consolidated income tax

Q70: The rules for computing Federal consolidated taxable

Q71: The Parent consolidated group reports the following

Q72: Tax incentives constitute the primary motivation for

Q75: Members of an affiliated group must share

Q76: The Rub, Sal, and Ton Corporations file

Q77: A wholly owned LLC can join the

Q79: Conformity among the members of a consolidated