Multiple Choice

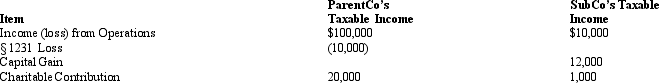

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's consolidated taxable income or loss.

Compute ParentCo and SubCo's consolidated taxable income or loss.

A) $91,000.

B) $100,800.

C) $112,000.

D) $122,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q86: The consolidated net operating loss of the

Q87: The right to file on a consolidated

Q109: In computing consolidated E & P,a negative

Q131: ParentCo purchased 100% of SubCo's stock on

Q135: In computing consolidated taxable income, a charitable

Q137: The group of Parent Corporation, SubOne, and

Q138: Cooper Corporation joined the Duck consolidated Federal

Q140: Campbell Corporation left the Crane consolidated tax

Q141: Over time,the consolidated return rules have shifted

Q141: Compute consolidated taxable income for the calendar