Essay

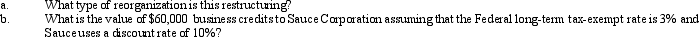

Present Value Tables needed for this question. Sauce Corporation is very interested in acquiring a controlling interest Pear Corporation, to obtain operating efficiencies. Sauce currently owns 30% of Pear, which it bought six years ago for $600,000. Sauce is a fruit processor with assets valued at $3 million and liabilities of $1 million. Pear supplies Sauce with fruit from its orchards that are valued at $4 million with $3 million in mortgages. Pear also has $60,000 in unused general business credits. Sauce has negotiated a restructuring with most of Pear's shareholders. It will exchange 1 share of its stock for 2 shares of Pear. Pear's founder, who own 10% of the outstanding common stock, is not willing to relinquish her stock and thus, Sauce cannot own 100% of Pear.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Mars Corporation merges into Jupiter Corporation by

Q13: Discuss the influence of step transaction,sound business

Q13: The continuity of interest requires that all

Q46: Compare the consideration that can be used

Q51: An exchange of common stock for preferred

Q54: Compare an acquisitive "Type D" reorganization with

Q69: For corporate reorganizations, the tax laws should

Q70: One of the tenets of U.S. tax

Q72: Which of the following statements is false

Q79: One of the tenets of the U.S.