Essay

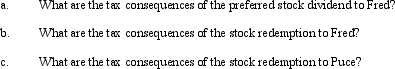

Fred is the sole shareholder of Puce Corporation, having a basis of $90,000 in 1,000 shares of Puce common stock. Last year, Puce (E & P of $500,000) issued a dividend of 2,000 shares of preferred stock to Fred. On the date of distribution, the fair market values per share of the common and preferred stocks were $160 and $20, respectively. In the current year, Puce (E & P of $720,000) redeems all of Fred's preferred stock for its fair market value of $40,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: What are the tax consequences of a

Q15: The built-in loss limitation in a complete

Q40: Abel owns all the stock of both

Q69: Vireo Corporation redeemed shares from its sole

Q75: When a shareholder receives property subject to

Q76: Kite Corporation has 1,000 shares of stock

Q77: Pursuant to a complete liquidation, Woodpecker Corporation

Q82: For purposes of the application of §

Q83: As a general rule, a liquidating corporation

Q84: The stock in Black Corporation is owned