Essay

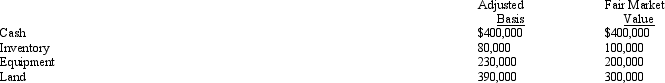

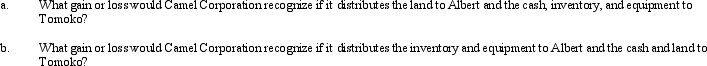

The stock in Camel Corporation is owned by Albert and Tomoko, who are unrelated. Albert owns 30% and Tomoko owns 70% of the stock in Camel Corporation. All of Camel Corporation's assets were acquired by purchase. The following assets are to be distributed in complete liquidation of Camel Corporation:

Correct Answer:

Verified

Correct Answer:

Verified

Q21: One difference between the tax treatment accorded

Q49: Kingbird Corporation (E & P of $800,000)

Q50: If a liquidation qualifies under § 332,

Q52: Ivory Corporation (E & P of $650,000)

Q53: Betty's adjusted gross estate is $7 million.

Q55: Hannah, Greta, and Winston own the stock

Q57: Which of the following statements is correct

Q58: In the current year, Donovan sells to

Q59: Indigo has a basis of $1 million

Q69: Explain the requirements for waiving the family