Multiple Choice

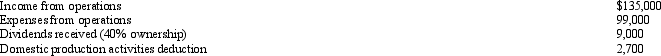

During the current year, Kingbird Corporation (a calendar year C corporation) had the following income and expenses:  On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $6,300 in cash (not included in any of the above items) . Determine Kingbird's charitable contribution deduction for the current year.

On October 1, Kingbird Corporation made a contribution to a qualified charitable organization of $6,300 in cash (not included in any of the above items) . Determine Kingbird's charitable contribution deduction for the current year.

A) $0.

B) $4,230.

C) $4,500.

D) $6,300.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Rajib is the sole shareholder of Robin

Q29: Compare the taxation of C corporations with

Q31: Juanita owns 45% of the stock in

Q32: Which of the following statements is incorrect

Q35: Flycatcher Corporation, a C corporation, has two

Q37: Osprey Company had a net loss of

Q38: Heron Corporation, a calendar year C corporation,

Q40: Black Corporation, an accrual basis taxpayer, was

Q41: Red Corporation, which owns stock in Blue

Q48: A personal service corporation with taxable income