Essay

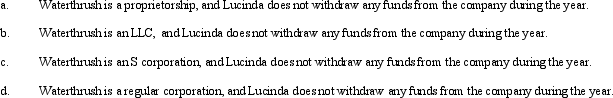

During the current year, Waterthrush Company had operating income of $510,000 and operating expenses of $400,000. In addition, Waterthrush had a long-term capital gain of $30,000. How does Lucinda, the sole owner of Waterthrush Company, report this information on her individual income tax return under following assumptions?

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Sage, Inc., a closely held corporation that

Q4: Jessica, a cash basis individual, is a

Q6: Describe the Federal tax treatment of entities

Q6: The passive loss rules apply to closely

Q14: A calendar year C corporation with average

Q37: Donald owns a 60% interest in a

Q47: Explain the rules regarding the accounting periods

Q77: Which of the following statements is incorrect

Q88: In the current year, Amber, Inc., a

Q110: Schedule M-2 is used to reconcile unappropriated