Essay

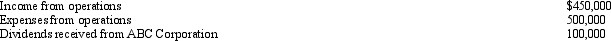

During the current year, Quartz Corporation (a calendar year C corporation) has the following transactions:

Quartz owns 15% of ABC Corporation's stock. How much is Quartz Corporation's taxable income (loss) for the year?

Quartz owns 15% of ABC Corporation's stock. How much is Quartz Corporation's taxable income (loss) for the year?

Correct Answer:

Verified

Quartz has an NOL, computed as...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: Schedule M-1 of Form 1120 is used

Q55: Eagle Company, a partnership, had a short-term

Q79: On December 30, 2011, the board of

Q81: Francisco is the sole owner of Rose

Q82: Vireo Corporation, a calendar year C corporation,

Q84: Nancy is a 40% shareholder and president

Q85: Katherine, the sole shareholder of Purple Corporation,

Q85: Peach Corporation had $210,000 of active income,

Q86: No dividends received deduction is allowed unless

Q88: There is no Federal income tax assessed