Essay

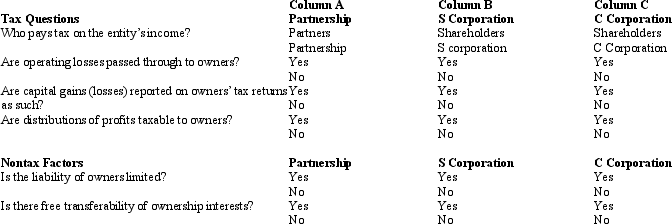

Compare the basic tax and nontax factors of doing business as a partnership, an S corporation, and a C corporation. Circle the correct answers.

Correct Answer:

Verified

The correc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The correc...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q20: Rajib is the sole shareholder of Robin

Q37: Osprey Company had a net loss of

Q38: Heron Corporation, a calendar year C corporation,

Q40: Black Corporation, an accrual basis taxpayer, was

Q41: Red Corporation, which owns stock in Blue

Q43: Jason, an architect, is the sole shareholder

Q44: Income that is included in net income

Q45: Ostrich, a C corporation, has a net

Q47: In the current year, Oriole Corporation donated

Q109: Schedule M-3 is similar to Schedule M-1