Multiple Choice

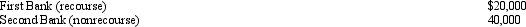

Bart contributes $160,000 to the Tuna Partnership for a 30% interest. During the first year of operations, Tuna has a profit of $30,000. At the end of the first year, Tuna has outstanding loans from the following banks.  What is Bart's at-risk basis in Tuna at the end of the first year?

What is Bart's at-risk basis in Tuna at the end of the first year?

A) $160,000.

B) $169,000.

C) $175,000.

D) $187,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: The § 465 at-risk provision and the

Q45: For a C corporation to be classified

Q72: What tax rates apply for the AMT

Q83: Of the corporate types of entities, all

Q96: From the perspective of the seller of

Q100: A business entity is not always taxed

Q129: Steve and Karen are going to establish

Q131: Some fringe benefits always provide a deduction

Q134: Trolette contributes property with an adjusted basis

Q138: Brown, Inc., has accumulated earnings and profits