Essay

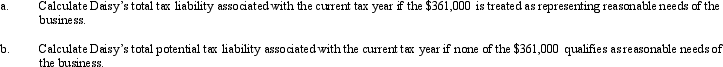

Daisy, Inc., has taxable income of $850,000 during 2011, its first year of operations. Daisy distributes dividends of $200,000 to its 10 shareholders (i.e., $20,000 each). Daisy earmarks $361,000 of its earnings for potential future expansion into other cities.

Correct Answer:

Verified

Correct Answer:

Verified

Q45: A corporation may alternate between S corporation

Q71: If the amounts are reasonable, salary payments

Q72: For a limited liability company with 100

Q73: Blue, Inc., has taxable income before salary

Q74: Colin and Reed formed a business entity

Q81: Barb and Chuck each have a 50%

Q94: Alanna contributes property with an adjusted basis

Q111: Which of the following is correct regarding

Q133: Melba contributes land (basis of $190,000; fair

Q162: Factors that should be considered in making