Essay

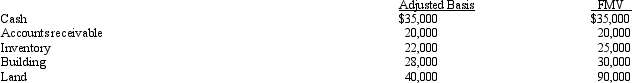

Lee owns all the stock of Vireo, Inc., a C corporation for which he has an adjusted basis of $150,000. The assets of Vireo, Inc., are as follows:

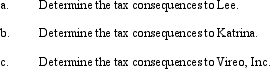

Lee sells his stock to Katrina for $200,000.

Lee sells his stock to Katrina for $200,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q12: Each of the following can pass profits

Q47: Roger owns 40% of the stock of

Q56: It is easier to satisfy the §

Q81: Which of the following statements is correct?<br>A)

Q85: If an individual contributes an appreciated personal

Q110: The tax treatment of S corporation shareholders

Q113: Do the § 465 at-risk rules apply

Q116: Aaron purchases a building for $500,000 which

Q122: Nontax factors that affect the choice of

Q129: An effective way for all C corporations