Multiple Choice

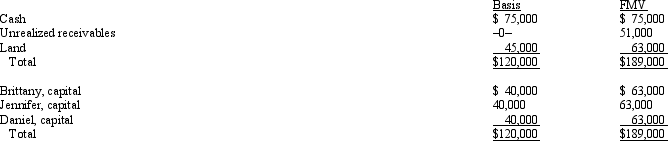

Brittany, Jennifer, and Daniel are equal partners in the BJD Partnership. The partnership balance sheet reads as follows on December 31 of the current year.  Partner Daniel has an adjusted basis of $40,000 for his partnership interest. If Daniel sells his entire partnership interest to new partner Amber for $73,000 cash, how much can the partnership step-up the basis of Amber's share of partnership assets under §§ 754 and 743(b) ?

Partner Daniel has an adjusted basis of $40,000 for his partnership interest. If Daniel sells his entire partnership interest to new partner Amber for $73,000 cash, how much can the partnership step-up the basis of Amber's share of partnership assets under §§ 754 and 743(b) ?

A) $6,000.

B) $18,000.

C) $23,000.

D) $33,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Several years ago, the Jaymo Partnership purchased

Q5: Megan's basis was $100,000 in the MAR

Q6: Mike contributed property to the MDB Partnership

Q7: A partnership may make an optional election

Q11: Martin has a basis in a partnership

Q25: Jared owns a 40% interest in the

Q36: Which of the following statements, if any,

Q126: If a partnership incorporates, it is always

Q131: Tyler's basis in his partnership interest is

Q175: For Federal income tax purposes, a distribution