Essay

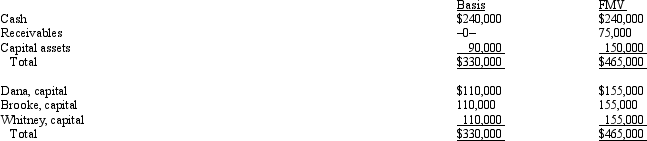

The December 31, 2011, balance sheet of the DBW General Partnership is as follows:

The partners share equally in partnership capital, income, gain, loss, deduction, and credit and capital is not a material income-producing factor. On December 31, 2011, general partner Dana receives a distribution of $155,000 cash in liquidation of her interest under § 736. Dana's outside basis for the partnership interest immediately before the distribution is $110,000. What is Dana's gain or loss on the distribution and its character?

The partners share equally in partnership capital, income, gain, loss, deduction, and credit and capital is not a material income-producing factor. On December 31, 2011, general partner Dana receives a distribution of $155,000 cash in liquidation of her interest under § 736. Dana's outside basis for the partnership interest immediately before the distribution is $110,000. What is Dana's gain or loss on the distribution and its character?

Correct Answer:

Verified

The $25,000 payment for Dana's share of ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q30: In a proportionate nonliquidating distribution, cash is

Q63: Which of the following statements is true

Q65: James, Justin, and Joseph are equal partners

Q67: In a proportionate liquidating distribution in which

Q70: Nicole's basis in her partnership interest was

Q86: Rex and Scott operate a law practice

Q97: Martha receives a proportionate nonliquidating distribution when

Q120: A disproportionate distribution arises when the partnership

Q144: Matt, a partner in the MB Partnership,

Q219: Michelle receives a proportionate liquidating distribution when