Essay

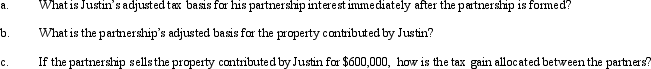

Greg and Justin are forming the GJ Partnership. Greg contributes $500,000 cash and Justin contributes nondepreciable property with an adjusted basis of $200,000 and a fair market value of $550,000. The property is subject to a $50,000 liability, which is also transferred into the partnership and is shared equally by the partners for basis purposes. Greg and Justin share in all partnership profits equally except for any precontribution gain, which must be allocated according to the statutory rules for built-in gain allocations.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: TEC Partners was formed during the current

Q26: The MOP Partnership is involved in leasing

Q27: Which one of the following statements regarding

Q28: Victor is a 40% owner (member) of

Q30: Stephanie is a calendar year cash basis

Q31: Section 721 provides that no gain or

Q33: The partnership reports each partner's share of

Q33: Morgan and Kristen formed an equal partnership

Q54: Which of the following statements is correct

Q79: A partnership will take a carryover basis