Essay

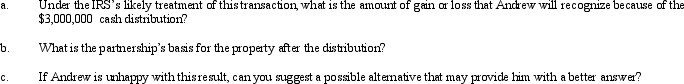

Andrew contributes property with a fair market value of $6,000,000 and an adjusted basis of $2,000,000 to AP Partnership. Andrew shares in $3,000,000 of partnership debt under the liability sharing rules, giving him an initial adjusted basis for his partnership interest of $5,000,000. One month after the contribution, Andrew receives a cash distribution from the partnership of $3,000,000. Andrew would not have contributed the property if the partnership had not contractually obligated itself to make the distribution. Assume Andrew's share of partnership liabilities will not change as a result of this distribution.

Correct Answer:

Verified

Correct Answer:

Verified

Q29: At the beginning of the year, Heather's

Q48: A limited liability limited partnership (LLLP) is

Q52: Partner Tom transferred property (basis of $20,000;

Q54: Marissa is a 50% partner in the

Q64: Tom and William are equal partners in

Q115: Emma's basis in her BBDE LLC interest

Q122: Crystal contributes land to the newly formed

Q143: When property is contributed to a partnership

Q153: Fern, Inc., Ivy Inc., and Jason formed

Q158: Katherine invested $80,000 this year to purchase