Essay

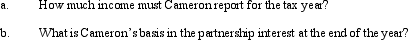

In the current year, the CAR Partnership received revenues of $400,000 and paid the following amounts: $160,000 in rent, utilities, and salaries; a $40,000 guaranteed payment to partner Ryan; $20,000 to partner Amy for consulting services; and a $40,000 distribution to 25% partner Cameron. In addition, the partnership realized a $12,000 net long-term capital gain. Cameron's basis in his partnership interest was $60,000 at the beginning of the year, and included his $25,000 share of partnership liabilities. At the end of the year, his share of partnership liabilities was $15,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: During the current year, MAC Partnership reported

Q17: Which of the following is not an

Q19: Which of the following statements is true

Q21: Tara and Robert formed the TR Partnership

Q22: On a partnership's Form 1065, which of

Q24: TEC Partners was formed during the current

Q33: The partnership reports each partner's share of

Q69: ABC, LLC is equally-owned by three corporations.Two

Q71: On January 1 of the current year,

Q89: Justin and Kevin formed the equal JK