Essay

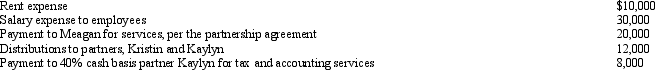

Meagan is a 40% general partner in the calendar year, cash basis MKK Partnership. The partnership received $100,000 income from services and paid the following other amounts:

How much will Meagan's adjusted gross income increase as a result of the above items?

How much will Meagan's adjusted gross income increase as a result of the above items?

Correct Answer:

Verified

$32,800. The $20,000 payment to Meagan i...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Maria owns a 60% interest in the

Q12: Harry and Sally are considering forming a

Q46: If a partnership allocates losses to the

Q75: The partnership must allocate nonrecourse debt among

Q76: During the current year, John and Ashley

Q81: Jamie contributed fully depreciated ($0 basis) property

Q82: Tyler and Travis formed the equal T&T

Q85: Joseph is the managing general partner of

Q156: On Form 1065, partners' capital accounts should

Q158: Which of the following is not a