Essay

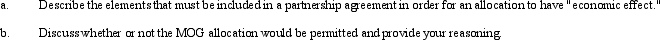

The MOG Partnership reports ordinary income of $60,000, long-term capital gain of $12,000, and tax-exempt income of $12,000. The partnership agreement provides that Molly will receive all long-term capital gains and George will receive all tax-exempt interest income. Their allocation of ordinary income will be reduced accordingly, and Olivia will be allocated a proportionately greater share of ordinary income. (In other words, each partner will receive allocations totaling 1/3 of the total $84,000 of partnership income.) This allocation was agreed upon because Molly and George are in a high marginal tax bracket and Olivia is in a low marginal tax bracket.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Maria owns a 60% interest in the

Q12: Harry and Sally are considering forming a

Q32: One of the disadvantages of the partnership

Q69: Rebecca is a partner in the RST

Q70: James and Kendis created the JK Partnership

Q72: Match each of the following statements with

Q74: Julie owns property that is treated as

Q75: The partnership must allocate nonrecourse debt among

Q76: During the current year, John and Ashley

Q90: Ashley purchased her partnership interest from Lindsey