Essay

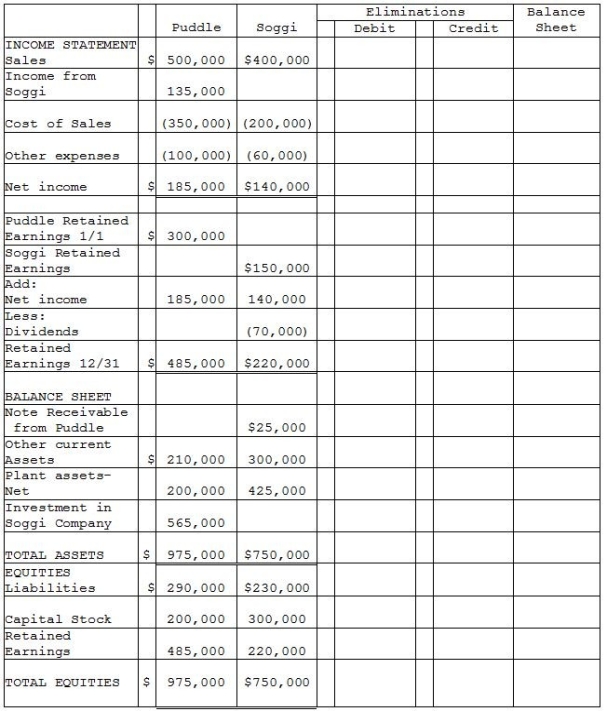

Puddle Corporation acquired all the voting stock of Soggi Company for $500,000 on January 1, 2014 when Soggi had Capital Stock of $300,000 and Retained Earnings of $150,000. The book value of Soggi's assets and liabilities were equal to the fair value except for the plant assets. The entire cost-book value differential is allocated to plant assets and is fully depreciated on a straight-line basis over a 10-year period.

During 2014, Puddle borrowed $25,000 on a short-term non-interest-bearing note from Soggi, and on December 31, 2014, Puddle mailed a check to Soggi to settle the note. Soggi deposited the check on January 5, 2015, but receipt of payment of the note was not reflected in Soggi's December 31, 2014 balance sheet.

Required:

Complete the consolidation working papers for the year ended December 31, 2014.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Pigeon Corporation acquired an 80% interest in

Q10: Platt Corporation paid $87,500 for a 70%

Q13: On December 31, 2014, Paladium International purchased

Q16: Flagship Company has the following information collected

Q17: On December 31, 2014, Patenne Incorporated purchased

Q19: Parakeet Company has the following information collected

Q27: A parent corporation owns 55% of the

Q35: Use the following information to answer question(s)

Q42: A parent company uses the equity method

Q48: When preparing consolidated financial statements,which of the