Essay

Address the following situations separately.

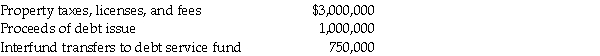

1. For the budgetary year beginning July 1, 2014, Coastal City expected the following cash flow resources:

In the budgetary entry, what amount did Coastal City record for estimated revenues?

In the budgetary entry, what amount did Coastal City record for estimated revenues?

2. During the fiscal year ended June 30, 2014, Western County issued purchase orders totaling $7,000,000. Western County received $6,500,000 of invoiced goods at the encumbered amounts and paid $6,100,000 toward them before year-end.

How much were Western County's encumbrances on July 1, 2014?

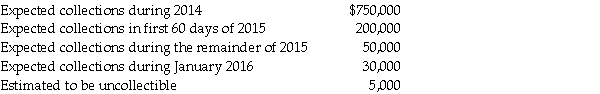

3. The following information pertains to property taxes levied ($1,035,000 total) by Southern Township for the calendar year 2014:

What amount did Southern Township report for property tax revenues in 2014?

What amount did Southern Township report for property tax revenues in 2014?

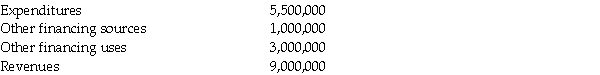

4. The following information pertains to Northern City's general fund for 2014:

At what amount will Northern City's total fund balance increase (decrease) in 2014?

At what amount will Northern City's total fund balance increase (decrease) in 2014?

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Use the following information to answer the

Q11: Bounty County had the following transactions in

Q14: Match the following fund balance descriptions for

Q18: At any point in time,a government will

Q19: For each of the following transactions relating

Q21: Which statement below is incorrect with respect

Q26: Goodwill County had the following transactions for

Q30: When a capital lease is used to

Q35: Assume you are preparing journal entries for

Q37: When recording an approved budget into the