Essay

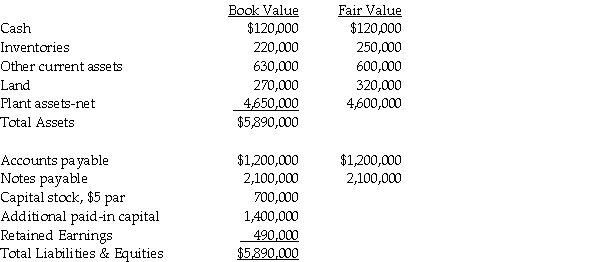

Parrot Incorporated purchased the assets and liabilities of Sparrow Company at the close of business on December 31, 2013. Parrot borrowed $2,000,000 to complete this transaction, in addition to the $640,000 cash that they paid directly. The fair value and book value of Sparrow's recorded assets and liabilities as of the date of acquisition are listed below. In addition, Sparrow had a patent that had a fair value of $50,000.

Required:

Required:

1. Prepare Parrot's general journal entry for the acquisition of Sparrow, assuming that Sparrow survives as a separate legal entity.

2. Prepare Parrot's general journal entry for the acquisition of Sparrow, assuming that Sparrow will dissolve as a separate legal entity.

Correct Answer:

Verified

1. General journal entry recorded by Par...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Samantha's Sporting Goods had net assets consisting

Q7: On January 2, 2013 Palta Company issued

Q9: Use the following information to answer

Q11: Balance sheet information for Sphinx Company at

Q12: According to FASB Statement 141R,which one of

Q13: Pony acquired Spur Corporation's assets and liabilities

Q14: Under the provisions of FASB Statement No.141R,in

Q21: According to FASB Statement No.141,liabilities assumed in

Q28: In a business combination,which of the following

Q46: With respect to goodwill,an impairment<br>A)will be amortized