Essay

Plymouth Corporation (a U.S. company) began operations on September 1, 2014, when the owner borrowed $250,000 to establish the business. Plymouth then had the following import and export transactions with unaffiliated Chinese companies:

September 6, 2014 Bought material inventory for 100,000 yuan on account. Invoice denominated in yuan

September 18, 2014 Sold 80% of inventory acquired on 9/6/14 for 110,000 yuan on account. Invoice denominated in yuan

October 5, 2014 Acquired and paid the 100,000 yuan owed to the Chinese supplier

October 18, 2014 Collected the 110,000 yuan from the Chinese customer and immediately converted them into U.S. dollars

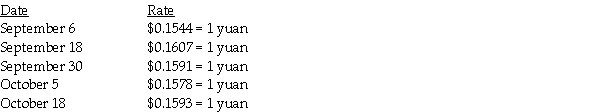

The following exchange rates apply:

Required:

Required:

1. What were Sales in the September month-end income statement?

2. What was the COGS associated with these sales?

3. What is the Accounts Receivable balance in the balance sheet at September 30, 2014?

4. What is the Inventory balance in the balance sheet at September 30, 2014?

5. What is the Exchange gain or loss that will be reported for the month of September?

Correct Answer:

Verified

1. Sales = September 18 sale of 110,000 ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: On December 5,2014,Unca Corporation,a U.S.firm,bought inventory items

Q5: Use the following information to answer the

Q19: On November 4,2014,the Oak Corporation,a U.S.corporation,purchased components

Q20: The table below provides either a direct

Q22: The exchange rates between the Australian dollar

Q24: A U.S.importer that purchased merchandise from a

Q25: If a U.S.company is preparing a journal

Q26: On May 1,2014,Deerfield Corporation purchased merchandise from

Q34: With respect to exchange rates,which of the

Q39: Use the following information to answer the