Essay

Meric Corporation (a U.S. company) began operations on January 1, 2014, when the owner borrowed $150,000 to start the company. In the first month of operations, Meric had the following transactions:

January 3, 2014 Bought inventory for 100,000 Brazilian real on account. Must be paid with Brazilian real

January 8, 2014 Sold 60% of inventory acquired on 1/3/14 for 32,000 British pounds on account. Invoice denominated in British pounds

January 10, 2014 Paid $3,000 in other operating expenses

January 23, 2014 Acquired and paid half of the Brazilian real owed to the Brazilian supplier

January 28, 2014 Collected half of the 32,000 pounds from the customer in Great Britain and immediately converted them into U.S. dollars

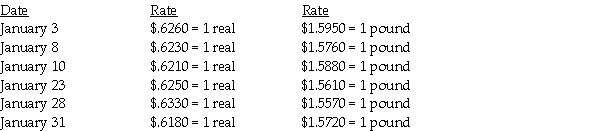

The following exchange rates apply:

Required:

Required:

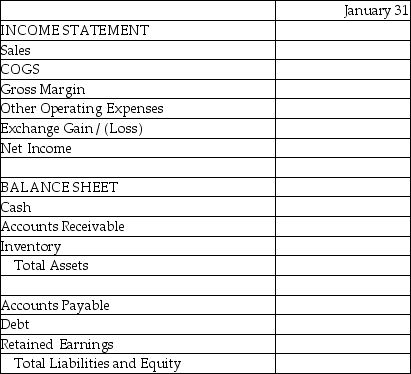

Complete the summary income statement and balance sheet for the month ended January 31, 2014 assuming there were no other transactions.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Use the following information to answer the

Q11: Johnson Corporation (a U.S. company) began operations

Q12: Which of the following statements is true

Q13: Charin Corporation, a U.S. corporation, imports and

Q14: Tank Corporation, a U.S. manufacturer, has a

Q20: A direct quote for the U.S.dollar is

Q20: The table below provides either a direct

Q24: A U.S.importer that purchased merchandise from a

Q35: On April 1,2014,Button Industries enters into an

Q44: When the billing for a U.S.company's sale