Multiple Choice

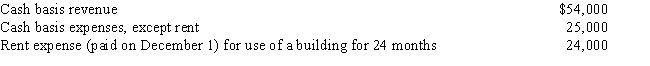

Becky is a cash basis taxpayer with the following transactions during her calendar tax year: What is the amount of Becky's taxable income from her business for this tax year?

A) $7,000 loss

B) $11,000

C) $27,500

D) $28,000

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Residential real estate is currently assigned a

Q51: On January 1, 2016, Sandy, a sole

Q52: Aaron has a successful business with $50,000

Q53: Give the depreciable or amortizable lives for

Q55: Eva purchased office equipment (7-year property) for

Q57: What is the maximum depreciation expense deduction

Q58: Countryside Acres Apartment Complex had the following

Q59: Betty purchases a used $12,000 car in

Q61: Shellie purchased a passenger automobile on March

Q81: Taxpayers choosing the election to expense:<br>A)May depreciate