Essay

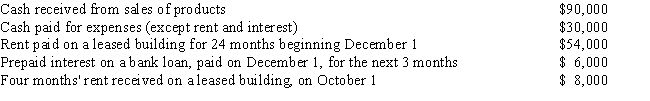

Polly is a cash basis taxpayer with the following transactions during the year:

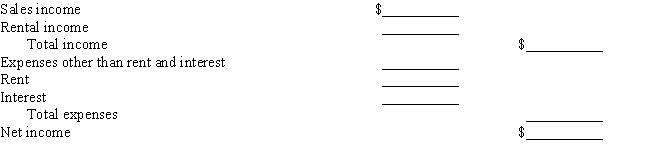

Calculate Polly's income from her business for this calendar year.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: All S corporations must use the accrual

Q3: On June 1, 2016, Cork Oak Corporation

Q5: Kate is an accrual basis, calendar-year taxpayer.

Q11: The maximum amount of depreciation including bonus

Q16: What is the minimum number of years

Q21: Mary sells to her father, Robert, her

Q31: Depreciation is the process of allocating the

Q45: ABC Corporation is owned 30 percent by

Q99: Under MACRS, the same method of depreciation

Q103: The annual automobile depreciation limitations apply only