Multiple Choice

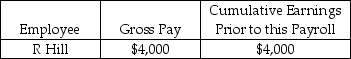

Great Lakes Tutoring had the following payroll information on February 28:  Assume:

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $106,800 and Medicare 1.45%

State Unemployment tax rate is 2% on the first $7,000

Federal Unemployment tax rate is 0.8% on the first $7,000

Using the information above, the journal entry to record the payroll tax expense for Great Lakes Tutoring would include:

A) a debit to Payroll Tax Expense in the amount of $390.

B) a credit to FUTA Payable for $24.

C) a credit to SUTA Payable for $60.

D) All of the above are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: FUTA taxes are paid:<br>A) by the end

Q4: The correct journal entry to record the

Q72: FIT Payable has a credit normal balance.

Q79: If Wages and Salaries Payable is debited,what

Q86: For each of the following, identify in

Q89: The employer's total FICA,SUTA,and FUTA tax is

Q93: A calendar quarter is made up of:<br>A)4

Q96: The 940 is filed annually.

Q96: Why would a company use a separate

Q111: The following data applies to the July