Essay

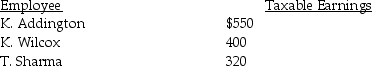

Using the information below, determine the amount of the payroll tax expense for B. Harper Company's first payroll of the year. In your answer list the amounts for FICA (OASDI and Medicare), SUTA, and FUTA.

Assume:

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $106,800 and Medicare 1.45%

State Unemployment tax rate is 5.0% on the first $7,000

Federal Unemployment tax rate is 0.8% on the first $7,000

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Employees must receive W-3s by January 31

Q12: Different deposit rules apply to employers based

Q42: A company must pay Form 941 taxes

Q57: Prepare the general journal entry to record

Q60: For each of the following, identify in

Q61: S.Ferrari,an employee of Plum Hollow Country Club,earned

Q65: A monthly depositor:<br>A)is an employer who only

Q89: The Wages and Salaries Expense account would

Q95: Businesses will make their payroll tax deposits

Q99: The following data applies to the July