Essay

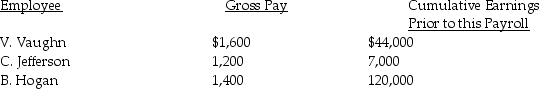

Using the information provided below, prepare a journal entry to record the payroll tax expense for Mr. B's Carpentry.

Assume:

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $106,800 and Medicare 1.45%

State unemployment tax rate is 2% on the first $7,000

Federal unemployment tax rate is 0.8% on the first $7,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Form 8109 is used to make deposits.

Q2: FUTA taxes are paid:<br>A) by the end

Q2: Prepaid Worker's Compensation Insurance is what type

Q4: The correct journal entry to record the

Q51: The following data applies to the

Q76: Prepare the general journal entry to record

Q79: As the Prepaid Workers Compensation is recognized,

Q96: Why would a company use a separate

Q106: The employer pays the same amount as

Q111: The following data applies to the July