Essay

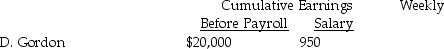

Sweetman's Recording Studio payroll records show the following information:

Assume the following:

Assume the following:

a)FICA: OASDI, 6.2% on a limit of $106,800; Medicare, 1.45%

b)Each employee contributes $40 per week for union dues

c)State income tax is 5% of gross pay

d)Federal income tax is 20% of gross pay

Prepare a general journal payroll entry.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Estimate the annual advance premium for workers'

Q4: Great Lakes Tutoring had the following payroll

Q8: For each of the following, identify in

Q20: Prepare the general journal entry to record

Q25: There is no limit on the amount

Q28: Ben's Mentoring had the following information for

Q57: Prepare the general journal entry to record

Q68: The W-3 is also known as the

Q109: The form used to complete the annual

Q127: Workers' Compensation Insurance is:<br>A) paid by the