Essay

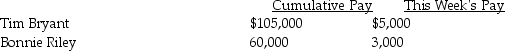

Compute the net pay for each employee listed below. Assume the following rates: FICA-OASDI 6.2% on a limit of $106,800; Medicare is 1.45%; federal income tax is 20%; state income tax is 5%; and union dues are $10.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q11: When calculating the employee's payroll, the clerk

Q22: The employee earnings record<br>A) shows all employee

Q24: Gross pay is equal to take-home pay.

Q30: Tracey Thrasher earned $800 for the week.If

Q39: Brian Temple's cumulative earnings are $73,000,and his

Q86: The use of a payroll register to

Q89: FUTA and SUTA are paid for exclusively

Q107: If the employee has $300 withheld from

Q127: An employee has gross earnings of $1,000

Q137: Compute net earnings on March 3,when gross