Essay

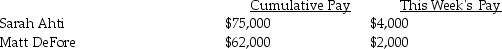

Compute the net pay for each employee. The FICA tax rate is: OASDI 6.2% on a limit of $106,800; Medicare is 1.45%; federal income tax is 15%; state income tax is 5%; and medical insurance is $100 per employee.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Clare's earnings during the month of February

Q83: On January 15,Robert Love earned $4,000

Q86: The use of a payroll register to

Q87: Ocean's Auction House's payroll for April includes

Q89: FUTA and SUTA are paid for exclusively

Q90: Given the following payroll items you are

Q91: Given the following payroll items you are

Q94: Ocean's Auction House's payroll for April includes

Q95: Net pay is equal to gross pay

Q137: Compute net earnings on March 3,when gross