Essay

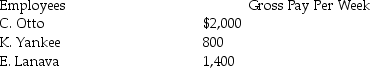

From the following data, determine the FUTA tax liability for Evans Company for the first quarter. The FUTA tax rate is 0.8% on the first $7,000 of earnings. (Assume all quarters have 13 weeks.)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q8: For which of the following taxes is

Q9: Carrie Stein's hourly wage is $40.00,and she

Q16: A company can deem an employee as

Q30: Both employees and employers pay which of

Q58: Which report would an employer review if

Q58: The payroll register<br>A) is a worksheet.<br>B) shows

Q63: Under the Fair Labor Standards Act,for any

Q85: Which tax does not have a wage

Q108: A maximum limit is set for all

Q124: To have less money withheld from your