Multiple Choice

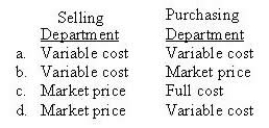

Which prices are recorded by departments under a dual-rate transfer pricing system?

A) Variable cost/Variable cost

B) Variable cost/Market price

C) Market price/Full cost

D) Market price/Variable cost

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q18: If manufacturing departments are only responsible for

Q37: If a product has an external market

Q40: Transfer pricing policies can affect a company's

Q52: When decision making is decentralised<br>A) Upper management

Q53: When a company uses activity-based transfer prices:<br>A)

Q54: Teresa's Taco Ltd had the following results

Q56: The National Division of Roboto Ltd is

Q58: A corporate accounting department would most often

Q61: How are research and development costs treated

Q62: The Geelong Division of the Wasson Widget