Multiple Choice

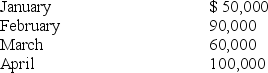

Gold Company has the following balances at 31st December 2010: Cash $6,000; accounts receivable $34,000 ($10,000 from November and $24,000 from December) ; merchandise inventory $40,000; and accounts payable $20,000 (for merchandise purchases only) . Budgeted sales follow:  Other data:

Other data:

· Sales are 40% cash, 50% collected during the following month, and 10% collected during the second month after sale. A 3% cash discount is given on cash sales

· Cost of goods sold is 40% of sales

· Ending inventory must be 140% of the next month's cost of sales

· Purchases are paid 70% in month of purchase and 30% in the following month

· The selling and administrative cost function is: $6,000 + $0.2 × sales. This includes $1,000 for depreciation

· All costs are paid in the month incurred

· Minimum cash balance requirement is $6,000

Cash receipts for April will be

A) $38,800

B) $77,800

C) $100,000

D) $68,800

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Differences between budgeted amounts and actual amounts

Q44: Intentionally understating revenues and / or overstating

Q59: Managers often use short-term loans or prearranged

Q60: ATR's budgeted product costs for the third

Q60: An advantage of a flexible budget is

Q64: Ray Company's projected sales budget for the

Q65: TFS Ltd, a retail company selling hotel

Q66: One objective of budgeting is motivating managers

Q67: The cash budget is included in an

Q87: In a production budget, beginning inventory plus