Multiple Choice

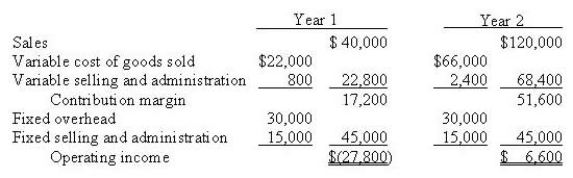

Taylor Ltd just finished its second year of operations. In the first year it produced 1,000 units and sold 400. The second year resulted in the same production level, but sales were 1,200 units. The variable costing income statements for both years are shown below:  The product cost per unit during year 1 using absorption would be

The product cost per unit during year 1 using absorption would be

A) $67,000

B) $73,000

C) $82,000

D) $85,000

Correct Answer:

Verified

Correct Answer:

Verified

Q42: Practical capacity is estimated based on<br>A) Engineering

Q43: Absorption costing will produce a larger operating

Q44: Total production overhead is treated as a

Q45: Brady Ltd uses a normal absorption costing

Q46: During its first year of operations, Kima

Q48: Throughput costing was an outgrowth of the

Q49: Absorption costing statements conform to generally accepted

Q50: The volume variance is calculated as<br>A) Difference

Q51: Brady Ltd uses a normal absorption costing

Q52: Philpott's operating profit using absorption costing is