Essay

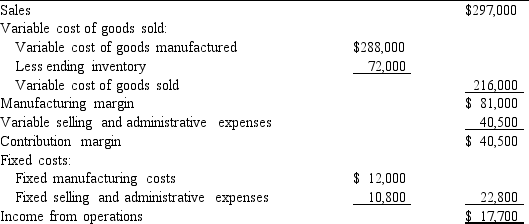

During the first year of operations, 18,000 units were manufactured and 13,500 units were sold.On August 31, Olympic Inc.prepared the following income statement based on the variable costing concept:

Olympic Inc.

Variable Costing Income Statement

For Year Ended August 31, 20--

Determine the unit cost of goods manufactured, based on a the variable costing concept and b the absorption costing concept.

Determine the unit cost of goods manufactured, based on a the variable costing concept and b the absorption costing concept.

Correct Answer:

Verified

a $16.00 $288,000 to...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Electricity purchased to operate factory machinery would

Q4: The contribution margin ratio is computed as<br>A)sales

Q20: The amount of income under absorption costing

Q39: Property tax expense is an example of

Q46: Managers in service firms do not find

Q63: Property taxes on a factory building would

Q66: For an accounting period during which the

Q80: For a supervisor of a manufacturing department,

Q125: The level of inventory of a manufactured

Q142: In which of the following types of