Essay

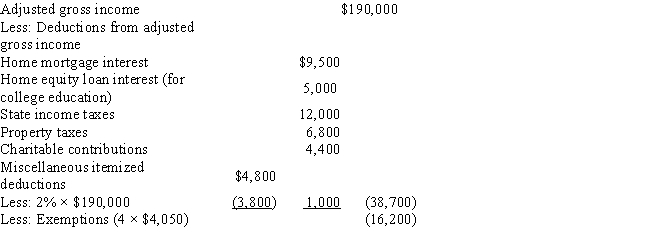

Rodrigo and Raquel are married with 2 dependent children,age 18 and 20,and reported the following items on their 2017 tax return:

Determine Rodrigo and Raquel's regular tax liability and,if applicable,the amount of their alternative minimum tax.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: On May 5,2015,Elton Corporation granted Germaine an

Q18: When calculating AMTI,individual taxpayers must add back

Q19: Jose is an employee of O'Hara Industry

Q21: Posie is an employee of Geiger Technology

Q23: A company that maintains a SIMPLE-401(k)has the

Q24: The Holden Corporation maintains a SIMPLE-IRA retirement

Q25: On September 15,2017,Spiral Corporation grants Jay an

Q26: Sergio is a 15% partner in the

Q27: Peter opened his IRA in 2003 and

Q75: The employee's contribution to a nonqualified pension