Essay

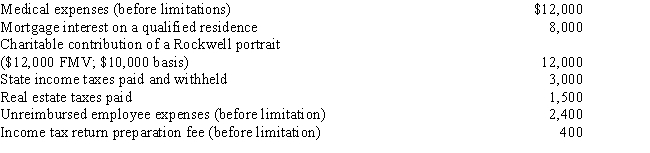

Eileen is a single individual with no dependents.Her adjusted gross income for 2017 is $60,000.She has the following items that qualify as itemized deductions.What is the amount of Eileen's AMT adjustment for itemized deductions for 2017?

Correct Answer:

Verified

Eileen must add back $6,100 of her itemi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Ross and Reba are both in their

Q7: Dunn Company bought an old building in

Q8: Under a nonqualified pension plan<br>I.The yearly earnings

Q10: Kathy and Patrick are married with salaries

Q14: One of the benefits of an incentive

Q28: To obtain the rehabilitation expenditures tax credit

Q45: Which of the following statements are correct

Q46: Sylvester is a U.S. citizen living in

Q62: Match the following statements:<br>-Alternative minimum tax<br>A)For the

Q78: Under a qualified pension plan<br>I.The yearly earnings