Essay

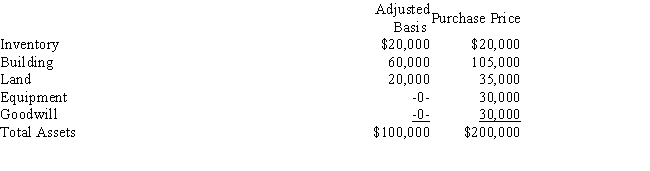

Dorothy operates a pet store as a sole proprietorship.During the year,she sells the business to Florian for $200,000.The assets sold and the allocation of the purchase price are as follows:

Dorothy acquired the building in 1997 for $100,000 of which $20,000 was allocated to the land.She paid $40,000 for the equipment in the same year.What are the tax consequences of the liquidation for Dorothy?

Correct Answer:

Verified

Dorothy will recognize a Section 1231 ga...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q33: Luisa,Lois,and Lucy operate a boutique named Mariabelle's

Q36: Cornell and Joe are equal partners in

Q39: Hawkins Corporation has $50,000 of taxable income

Q40: During the current year,Campbell Corporation receives dividend

Q41: Brooks Corporation distributes property with a basis

Q56: Louise is the marketing manager and a

Q62: Anna owns 20% of Cross Co., an

Q67: Hammond Inc., sells a building that it

Q83: Match the term with the entity to

Q93: When a partnership distributes property that has