Multiple Choice

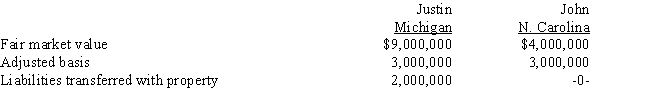

Justin trades an office building located in Michigan to John for an apartment complex located in North Carolina.Details of the two properties:

In addition,John pays Justin $3,000,000 cash as part of this transaction.What is the gain (loss) recognized by John in this transaction and what is his basis in the Michigan property?

Gain Recognized Adjusted Basis

A) $1,000,000 $9,000,000

B) $ -0- $8,000,000

C) $1,000,000 $6,000,000

D) $ -0- $9,000,000

E) Some other amounts

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Cindy exchanges investment real estate with Russell.

Q17: A gain on a like-kind exchange is

Q24: Rosilyn trades her old business-use car with

Q27: No taxable gain or loss is recognized

Q46: Donald and Candice sell their home for

Q54: Tony and Faith sell their home for

Q61: Rationale for nonrecognition of property transactions exists

Q82: Benito owns an office building he purchased

Q95: Charlotte's apartment building that has an adjusted

Q97: Which of the tax concept(s) allow for